There are many costliest cities in the United Arab Emirates including Dubai & Abu Dhabi. These cities are expensive and that's why citizens & expatriates face many financial issues. Therefore, the only solution to deal with this situation is to choose a debt. All financial institutions including banks and online lenders offer loans to their clients at lower interest rates. Whenever you need a loan, compare different kinds of loans and lenders. It helps you choose the best kind of loan according to your financial requirements. One of the loans that most borrowers select to meet financial needs is a buyout loan.

This loan is different from other kinds of loans. With the help of a buyout loan, an individual can pay off his existing debt. And, then his focus is on the paying of a new loan only. This debt is widely available to the lenders. The financial institution of the existing loan is changed to a new one. A borrower must pay off the monthly payments of new debt continuously. Some of the terms & conditions remain the same but some may change if the loan provider allows. In this way, borrowers feel relaxed during the paying of payments. The financial company Emirates Loan offers buyout loans to every individual who needs to settle their financial problems. If you decide to take it, you should check if the new debt comes with lower interest or not. The lower interest means that the overall cost of the debt is also lower. You will pay reasonable repayments per month and also easily manage your financial budget to meet other expenses.

The process of a buyout loan is not very complicated. It requires proper time and attention. You need to carefully understand it because then you will be able to easily pay off a new debt and free from the stress of paying existing debt. The parties included in the process of this loan are borrowers, investors, and financial institutions.

Investors will only provide this loan when they completely agree with the debt terms. You have to check different investors to choose the best one. Always prefer to take a buyout debt at a lower cost of interest. The lower interest makes the debt less expensive and you will easily pay it off without extra financial burden.

The financial institutions involved in the buyout debt are of two different kinds. One institution is where you are paying the payments of an existing loan. And the other institution is where you want to obtain a new payout debt. This new debt comes with more favorable terms as compared to the existing one.

There are numerous benefits that a borrower will get when obtaining a buyout loan. Due to these benefits, it is a worthy loan option for the borrowers. All borrowers choose it when they face a financial crisis. The most prominent benefits of this loan are:

If you are paying many payments of different loans at the same time, it becomes hectic to continuously pay off the amount. In this scenario, debt consolidation is an impressive option. The buyout debt is good for consolidating all your existing debts.

You will get more access towards getting of higher finances. You can apply for a higher amount of debt. With it, you will not only consolidate previous debts but also meet your other financial expenses.

Interest rates are very competitive. So, borrowers pay off their debts with lower interest rates per month. Every monthly installment contains the amount of interest. You have to pay these installments continuously. In this way, the overall cost is lower and there is not much difficulty in paying for it.

All terms are flexible to give more financial relaxation to borrowers. The flexible repayment terms are ideal to conveniently pay down the entire amount.

All banks and financial institutions have their particular criteria of eligibility. Emirates Loan provides the complete details of eligibility. So, a borrower will apply with complete confidence that there is no chance of rejection of the loan application. You need to know all these factors of eligibility criteria:

It is essential that borrowers must pay thirty percent of their existing debt. Then, they will be eligible to obtain a buyout loan to consolidate the existing one.

The duration of the loan must be at least six months. You will not get it in case of paying installments of new loans.

Your financial record must be without the information of any missed or delayed repayments. It is because the missed payments show that a borrower is not sincere towards paying repayments on time. Thus, it becomes difficult to obtain a new buyout finance.

It is available for every kind of loan that individuals may take to settle their daily financial expenses. For instance, if you are paying a home loan, you can apply for it. In addition to home loans, all other loans can easily be paid down through it such as education, medical loan, etc.

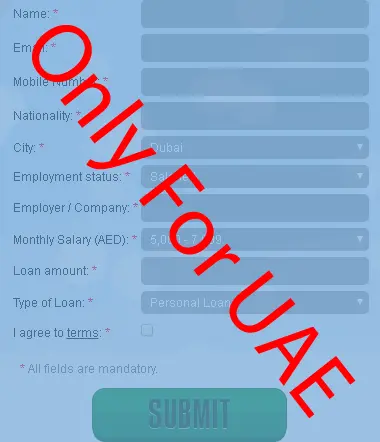

With eligibility criteria, it is necessary to provide all authentic documents with the loan application. Otherwise, your application will not get approval by the lender. The lenders check the validity of documents and then they provide the debts. The required documents are:

Salary certificate of recent few months

Bank statements

Your valid Emirates ID Passport & visa copy

Some lenders demand a supporting document that shows the reason for your applying for a buyout debt.

The bottom line The financial market is wider in the UAE. That’s the reason for the huge popularity of buyout loans. With the loan, everyone gets benefits from it such as borrowers, investors, and financial institutions. If you face difficulty in paying the monthly installments of an existing loan, you should choose a buyout loan. Thereby, you will conveniently pay down the amount without any financial stress. You will get a chance to avail of a debt with changed terms of repayments.

For Example, Mr. Sheiklh apply a loan of AED 100,000/- for 3 years and interest rate is 10% APR.

1-year interest will be = 10,000/- and 3-years interest will be = 30,000/-

Principle amount = 100,000/- Total interest = 30,000/-

Total amount payable in 3 years (36 month) = 130,000/-

Monthly installment will be = 3611.11/- Processing fee will 1% of Loan amount = 1000/-