No matter you are an ex-pat or a national of UAE, a Business loan in UAE helps you if you want to enhance your business and don’t have a sufficient amount to do it. No problem Emirates Loan is here every time to sort out your problems with business loans in Dubai. You can get Business Loan through Emirates Loan. Forgetting Business Loan you have to fill the form shown on your right side.

First of all, we have to think about what is a permanent livelihood. The people who think Job is the permanent with due respect we disagree with that school of thought. If you are doing a job in the specific with god package. Only the specific time is the good period of your life. If we do not focus on the future. We must fail in the upcoming life. Every job has set some specific retirement age for their employees. When we become retire from the age our decrement of life is started. So the appropriate solution to prevent yourself from the economical disaster of the life is the business loan in UAE. We should understand that only business is our permanent livelihood.

We are not against to job. We are trying to emphasize that the business is your permanent livelihood rather than the job. The most fortunate thing is that our education system makes servants, not entrepreneurs. No doubt to take an initiate we should do the job to take the experience in the market because if you do not know about the entire technique of market you cannot run your business. Now let us discuss how you can initiate your business through emirates money business loan.

We all know that a self-made person has no massive bank balance to take an impressive initiate. We should concern a beneficial loan scheme. As we know in all the schemes of loan have some specific fraud in their hidden policies. Our duties are to mentioned the right business loan company which provides you a loan with convenient policies. You have no need to concern banks and their disturbing behavior when you have an Emirates loan.

Get ready all entrepreneurs because through our small business loan facility your business is going to be on the next level. With the high-level business loan, we also offer a variety of small business loans as well. Any kind of business you have and any kind of strategy you are following, no issue. Because our small business loan in UAE can handle all kinds of small expenses related to your running business in UAE.

Now the time is changed and the ways of getting a business loan are also modified with time. Now anyone can get this facility while sitting in a home. Yes, this can be done through an online service, the method of obtaining the loan this way is also very easy. Even you will get your required info there also about any kind of loan and any category of business loan. Taking online business loans is now becoming a trend in UAE and everybody wants to know the method of it. Because no one wants to go outdoors to take that loan.

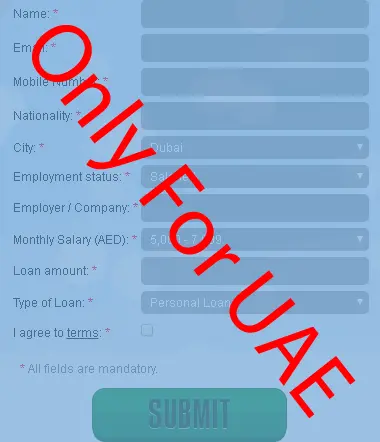

The most important and commonly asked question is about the online application procedure for the business loan. The answer is that if you have an access to the Internet at home so it’s not a big deal for you at all. Go through the various websites of banks and put your details on available forms of application related to that loan. business loan application online will give you the confidence to make your life more comfortable via applying by yourself. You do not have to need something different to learn for the application procedure. If you don’t have any idea about applying just call to bank or visit the website to check out the procedure. The staff of the bank will guide you and they can make that task easy for you.

You will find out a huge variety of various lenders that are providing online business loan facilities. you can easily contact them and try to attain their online services. The functions that online money lenders are operating are based on various strategies. There can be many private organizations also exists there that are serving the people through their business loan facility. Even though there are many online software and apps available and ready to serve, but you have to be careful about those online services. Because many lenders are not real and they may make you fooled by their attractive deals with a business loan.

A business loan can do lots of tasks that can not be done through other sources. As a business owner, you should be aware of all the risks and benefits associated with the business. So, we recommend you that apply for a business loan to sort out all relevant problems arising in your business. Make your labor and other staff members happy by giving them the other kind of facilities also within the range of your working place. That would be better for the development of your business graph, most owners take that loan for the maintenance of their business expenses accurately.

Taking a business loan will be effective and beneficial in terms of huge investment also. Sometimes, there is a need for some investment with which business can be expanded within the country. You can also spread it out outside the country. To achieve that goal taking loan will be the best option and it will be helpful to maintain the market value of your business also. But make sure the business loan interest rate in UAE should be suitable for you and your business. So, that you can easily pay your monthly installments with an adjustable interest rate. For such purpose, you should select the best bank in UAE and you can also take loans from Islamic banks. Because their interest rates are better than and lowest than the other banks.

No issue, whether you own a small business or run a business on a huge level. You should always select the bank that can give you the lowest interest with the best duration for the repayment. Because the investment process can be time-consuming and therefore monthly repayment may delay. So, getting a good duration for repayment is also necessary with the business loan interest rate in Dubai. The most important thing that you should keep in your mind is the EMI calculation of your loan. It would be better for you to calculate your monthly basis installment initially or before applying. So, you will not face any difficulty after applying, calculate your business EMI and get the idea about the exact installment.

The term business loan is not a small concept but it contains a vast concept related to all categories of business. It can be on a small-scale, large-scale, or semi-scale level business. Some people want to get a business loan to broaden their business as well as the annual revenue generation capacity. This loan can be taken due to lots of reasons that are prevailing in the business. For example, if you want to launch a new product into the market but don’t have enough capital for the production and distribution process. So, this business loan will help you out in this matter and you can easily implement your idea.

Similarly, after the implementation process, there are semi-scale business tasks, that need attention more because it consists of both qualities small and large. The maintenance work, hiring of labor force work, purchasing of raw material, new packaging, and printing strategy are major parts of such business. Therefore, all these goals can be achieved with the help of business finance in the UAE. After the investment, production, launching and advertising of a product, your business will grow faster, higher and smoother than before.

Business loans serve as a powerful tool to help fund, launch, and grow a small business. As a small business owner, you may be looking to secure financing to maintain business operations, expand locations, invest in new equipment, or hire more employees. A business loan helps you achieve all this.

You can apply for online business loans as well as an emirates credit card in UAE Emirates loans. They have records of honesty and friendly behavior they will do anything in which you are comfortable. Moreover, they have different services to provide credit card services, business loans, personal loans, and home loans, etc.

Visit the website https://www.emiratesloan.info/ and get your loan on the specific terms and condition which you will find on the website.