One year from now might be additionally trying for banks in the UAE, as their resource quality and productivity are estimated to debilitate on the rear of proceeded within the economy and land area.

Low oil costs, combined with continuous moderating measures, for example, the deferment of obligation installments, could likewise bring about more awful obligations accumulating, S&P said in its most recent examination.

"The fall in oil costs and monetary log jam will provoke an ascent in issue advances and the expense of danger when the land area was under huge pressure," the organization of the evaluation said in a report.

"As a result of continuous administrative restraint measures, we envision that non-performing advances will arrive at a top in 2021," it added.

The image is the same in different business sectors. The evaluations office has anticipated a more troublesome year ahead for banks the world over, referring to that 2021 "could end up being the hardest test" for loan specialists since the consequence of the 2009 worldwide monetary emergency.

"This year has been hard for banks. One year from now might be considerably harder," S&P said.

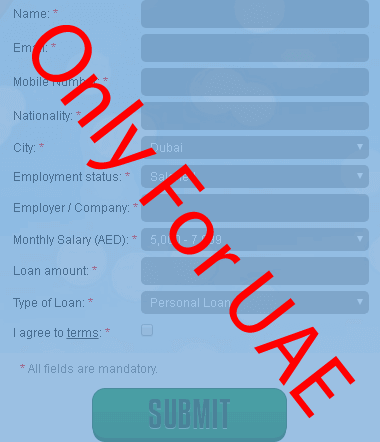

The UAE has revealed a progression of improvement bundles and activities to relieve the monetary effect of the Covid pandemic, allowing rent respites, conceding advance reimbursements, and opening up without interest credit lines to organizations and people.

In any event, 310,000 clients have so far profited by the UAE's advance delay activity since the beginning of the Covid pandemic.

Credit Misfortunes

S&P said the unwinding of certain prudential necessities could disintegrate banks' solid capital cushions, and that credit misfortunes could shoot up to 200 premise focuses (bps), particularly given that some significant organizations are confronting some difficult issues.

One of the setup associations in the UAE, Arabtec, has as of late declared investors' choice to disintegrate the organization.

"The misrepresentation case in one huge corporate and the new liquidation of a significant development organization, joined with banks' systems to begin constructing extra arrangements, will push credit misfortunes to 180 bps-200 bps," S&P said.

"Bank benefit in staying low. Edges have fixed by 30 bps-40 bps because of lower financing costs. Lower edges and higher credit misfortunes would prompt lower productivity for UAE banks. We trust UAE Banks' decreased productivity will last more because of the high extent of non-premium bearing stores in their subsidizing structures and lower-income on the resource side," it added.

(Detailing by Emirates Loan)

Disclaimer: This article is accommodated enlightening purposes as it were. The substance doesn't give charge, lawful or speculation counsel or assessment with respect to the reasonableness, worth, or benefit of a specific security, portfolio, or venture technique. Peruse our full disclaimer strategy here.